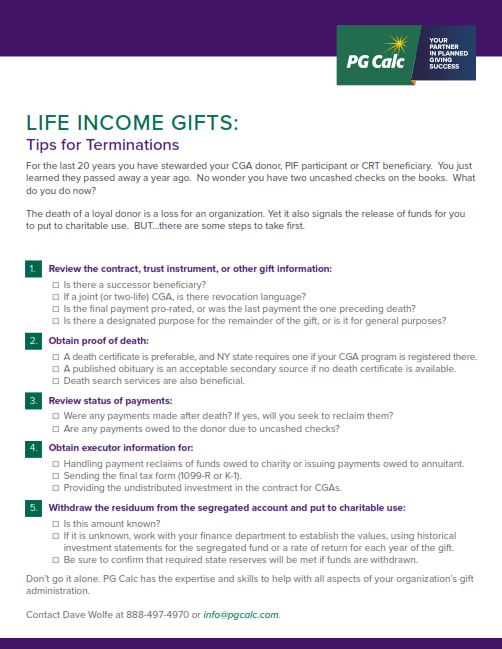

charitable gift annuity administration

A GRAT is generally used to transfer rapidly appreciating or high income-producing property to heirs with the main goal of transferring free of federal gift tax a portion of any appreciation in or income earned by the trust property during the annuity period. The gift tax return may also affect your estate tax.

Pooled Special Needs Trust Administration since 1990.

. For example the rate for a person age 80 will increase from 65 to 7. Pacific Repertory Theatre PacRep was created in 1983 to encourage facilitate and produce theatre arts in the Monterey Bay region and to provide facilities. This includes paying all financial obligations distributing trust property to beneficiaries filing final tax returns and providing a final Trust AccountingIn order for a trust to end all debts must be paid and all.

A type of gift transaction in which a donor contributes assets to a charitable trust which pays an annuity designed to leave a substantial proportion of the. In this blog post simply to point out the possibility of needing to file an IRS Form 709 gift tax return when funding a charitable remainder annuity trust. Charitable Remainder Annuity Trust.

Increasing the top tax rate for individuals to 396. I am impressed with the staffs knowledge friendliness and professionalism. I recommend CCT to colleagues and clients who are in need of an experienced pooled trust administrator.

Graduate Adult POA GAP Package. This means that the ACGA indicated that most single life gift annuity contracts increase rates from 04 to 06 more depending on the age of the annuitant. Specialized Trusts are only part of Regions comprehensive wealth planning.

The maximum rate for a single life gift annuity will be 91 and for a two-life gift duty will be 88. CCT makes establishing the trust easy and convenient and the distribution process is seamless. This article provides instructions on how to close a trust.

Including a deduction for estate or gift tax purposes cannot have a total value of more than 60 of the total FMV of all amounts in the trust. Before closing or dissolving a trust the trustee must complete all steps in the trust administration process. Imposing a minimum tax on.

Probate Trust Administration. The gift will use some of the settlors 1000000 tax-free amount unified credit or if that amount is exhausted from prior gifts require the payment of gift tax. The Biden Administrations FY 2023 Budget and Treasury Greenbook released March 28 2022 propose changes to the rules for taxing certain individuals estates and trusts as well as broadening the circumstances under which capital gains become taxableThe proposed changes include.

The amount of the gift is the fair market value of the residence less a discount based on the delay in the beneficiaries receipt of the residence and the settlors age. For a sample form of a trust that meets the requirements of a testamentary charitable lead annuity trust see Rev.

4 Long Term Ways To Give To Charity Capstone Financial Advisors

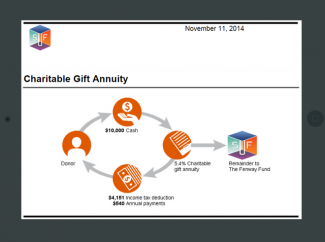

Charitable Gift Annuities Giving To Duke

Cga Services National Christian Foundation

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Income Generating Gifts Harvard Medical School

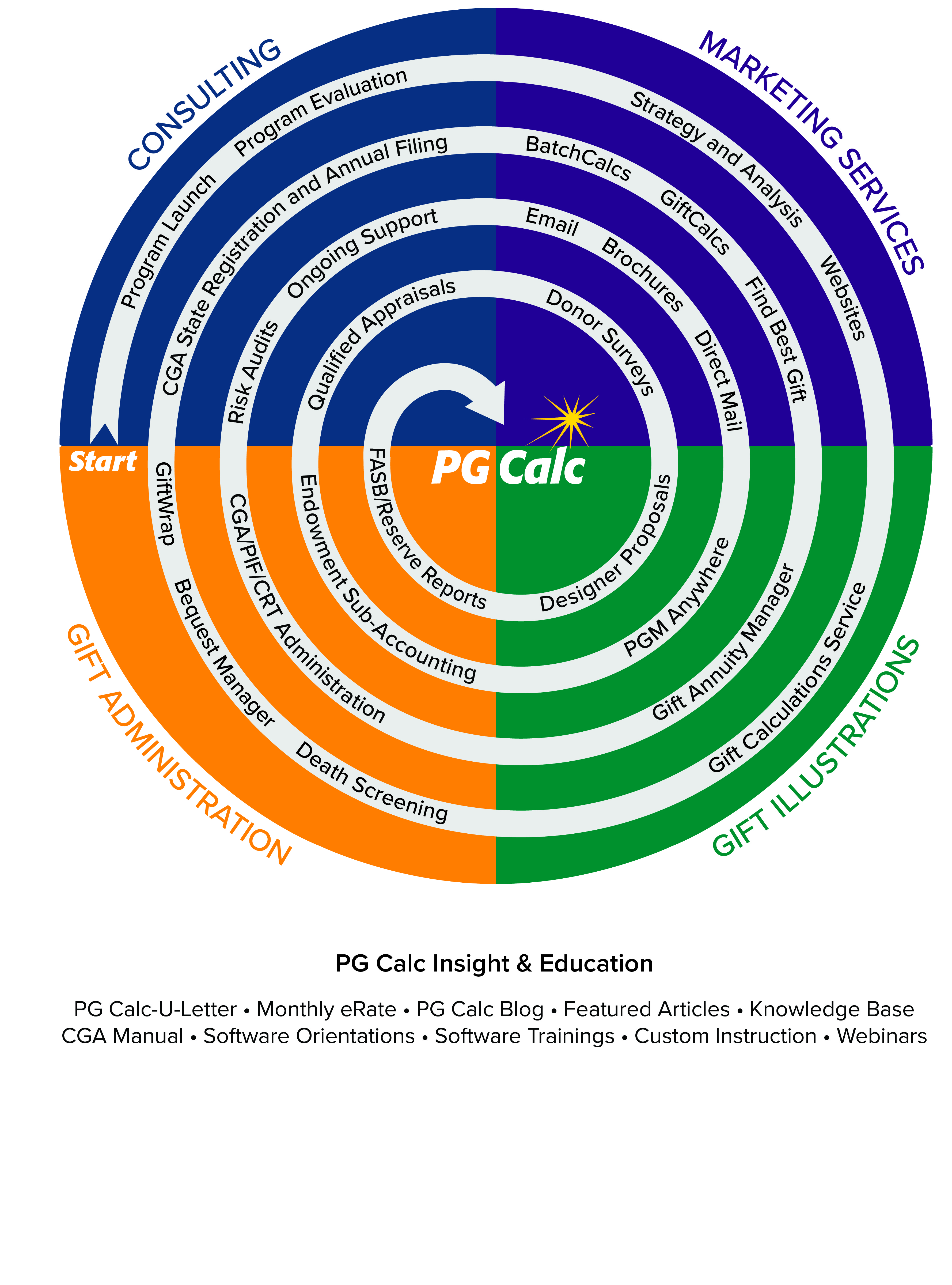

Pg Calc And Planned Giving Pg Calc

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Is It Worth Starting A Charitable Gift Annuity Program Cck Bequest